The Ultimate Guide To Summitpath Llp

The Ultimate Guide To Summitpath Llp

Blog Article

Not known Details About Summitpath Llp

Table of ContentsThe Ultimate Guide To Summitpath LlpThe 15-Second Trick For Summitpath LlpNot known Details About Summitpath Llp Get This Report on Summitpath Llp

Most lately, released the CAS 2.0 Method Growth Training Program. https://hearthis.at/summitp4th/set/summitpath-llp/. The multi-step training program includes: Pre-coaching alignment Interactive group sessions Roundtable conversations Individualized mentoring Action-oriented mini prepares Companies aiming to expand right into consultatory services can additionally transform to Thomson Reuters Technique Ahead. This market-proven technique offers web content, devices, and advice for companies interested in consultatory solutionsWhile the changes have actually opened a number of development possibilities, they have additionally resulted in obstacles and issues that today's companies require to have on their radars., firms must have the capacity to promptly and efficiently carry out tax obligation research and enhance tax obligation coverage effectiveness.

Driving greater automation and making certain that systems are firmly incorporated to streamline process will certainly assist alleviate data transfer issues. Companies that remain to operate siloed, heritage systems risk wasting time, money, and the trust of their customers while raising the opportunity of making mistakes with hands-on access. Leveraging a cloud-based software application solution that functions effortlessly together as one system, sharing information and procedures across the firm's process, can confirm to be game-changing. On top of that, the new disclosures may cause a boost in non-GAAP actions, historically an issue that is extremely scrutinized by the SEC." Accountants have a lot on their plate from regulatory adjustments, to reimagined organization models, to a boost in customer expectations. Equaling it all can be difficult, but it does not have to be.

More About Summitpath Llp

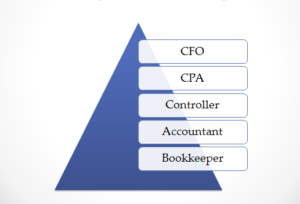

Below, we explain four CPA specialties: taxes, administration accounting, financial coverage, and forensic audit. Certified public accountants focusing on taxes assist their customers prepare and submit income tax return, lower their tax obligation burden, and avoid making errors that can bring about pricey charges. All Certified public accountants require some expertise of tax obligation regulation, but specializing in taxation suggests this will certainly be the emphasis of your job.

Forensic accounting professionals normally begin as basic accountants and move into forensic accountancy duties over time. CPAs who specialize in forensic accountancy can often move up right into management audit.

No states need an academic degree in audit. However, an bookkeeping master's level can aid students fulfill the certified public accountant education and learning need of 150 credit histories considering that many bachelor's programs only call for 120 debts. Accounting coursework covers subjects like financing - https://www.reddit.com/user/summitp4th/, auditing, and taxation. Since October 2024, Payscale records that the typical yearly income for a certified public accountant is $79,080. bookkeeping service providers.

Accounting also makes useful feeling to me; it's not simply theoretical. The Certified public accountant is a crucial credential to me, and I still get proceeding education and learning credits every year to keep up with our state demands.

Summitpath Llp - Questions

As a freelance consultant, I still use all the fundamental foundation of bookkeeping that I found out in college, seeking my CPA, and operating in public audit. Among things I really like about audit is that there are several jobs available. I decided that I intended to begin my profession in public audit in order to discover a great deal in a short amount of time and be exposed to different kinds of customers and different areas of accounting.

"There are some workplaces that don't wish to think about somebody for an accounting role that is not a CERTIFIED PUBLIC ACCOUNTANT." Jeanie Gorlovsky-Schepp, CPA A CPA is an extremely beneficial credential, and I wished to place myself well in the industry for different tasks - Bookkeeper Calgary. I chose in college as an accountancy significant that I intended to try to get my CPA as quickly as I could

I have actually met a lot of fantastic accountants that don't have a CERTIFIED PUBLIC ACCOUNTANT, yet in my experience, having the credential really aids to market your knowledge and makes a difference in your settlement and career alternatives. There More Bonuses are some work environments that do not intend to think about someone for a bookkeeping role that is not a CERTIFIED PUBLIC ACCOUNTANT.

The Of Summitpath Llp

I truly enjoyed working on numerous sorts of projects with different clients. I found out a whole lot from each of my colleagues and customers. I dealt with several not-for-profit organizations and found that I have an interest for mission-driven companies. In 2021, I decided to take the following action in my accounting job trip, and I am currently a self-employed accounting consultant and service expert.

It continues to be a growth area for me. One important top quality in being a successful certified public accountant is genuinely caring about your clients and their businesses. I love dealing with not-for-profit clients for that really reason I seem like I'm actually adding to their objective by aiding them have great economic details on which to make clever company choices.

Report this page